portability of estate tax exemption 2019

Pursuant to legislation passed in 2014 the Maryland estate tax exemption continues to increase as follows. The estate tax exemption dates back to the Revenue Act of 1916 when the federal government started taxing estates valued at over 50000.

If one spouse dies before another and doesnt use 100 of hisher estate tax exemption the surviving spouse can use the remaining exemption plus hisher own exemption.

. Foreseeing the inflation the TCJA has. Assume that at the time of Jennifers later death the federal estate tax exemption is still 5340000 the estate tax rate is 40 percent and Jennifers estate is still worth 8000000. The 2021 federal estate tax exemption has been large for 2021 the exemption is 117 million.

There are several types of exemptions people with disabilities or individuals over 65 can be eligible for. A total exemption excludes the entire propertys appraised value from taxation. Portability of Unused Estate Tax.

That amount is per person. Prior to 2011 the concept of portability didnt even exist in the law so most estate plans used credit shelter or bypass trusts for surviving spouses to utilize the exemption. Unfortunately couples that include a non-citizen non-US.

To use portability an estate tax return must be filed. Taxing units are required by the state to offer certain mandatory exemptions and have the option to decide. The 2019 federal exemption for gift and estate taxes is 11400000 per person.

As of 2021 the federal estate tax exemption is 114 million. The Internal Revenue Service IRS has announced the estate tax exemption and gift tax exemption amounts for 2019. All residence homestead owners are allowed a 25000.

The 2019 Federal estate tax exemption will be 114. The estate of a deceased non-citizen cannot elect. The tax exemption change works with the federal gift and estate tax where the TCJA act doubles the existing exemption from 5 million to 10 million.

This exemption stayed in place for. For a married couple the total amount is 234. However this exemption is due to end in 2025 unless the law is extended.

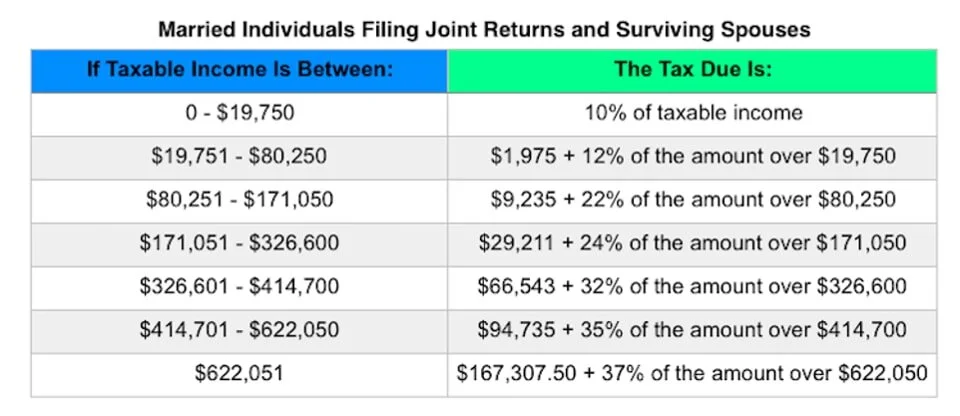

2018 -- 4000000 an increase of 1000000 from 2017 2019 and. For example if Bob and Sally are married and Bob dies in 2011 and only uses 3000000 of his 5000000 federal estate tax exemption then Sally can. When an individual dies the value of that individuals estate is subject to estate taxation which is currently 40 of the individuals taxable estate.

The option of estate tax exemption portability can make a significant difference when it comes to taxation of an estate. The exemption is in fact indexed annually for inflation so it does increase over time. Resident may not be able to take advantage of estate tax portability.

The exemption is subtracted. If making a portability election a surviving spouse can have an exemption up to 228 million.

What Is The Federal Estate Tax Sunshine Financial Solutions Insurance Retirement College Funding And Business Solutions

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Estate Tax Portability Is It Available To Non U S Citizens California Probate Law Offices Of Janet Brewer Blog

Grantor Retained Annuity Trusts A Unique Estate Planning Solution Fi3 Advisors

Portability Of The Estate Tax Exemption How It Works

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

Late Portability Election New Relief Available New York Law Journal

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

Overview Of 2019 Estate Exemptions Tax Epilawg

Bypassing The Bypass Trust With Permanent Portability

Great News For Those Missed The Portability Filing Deadline Karp Law Firm

Estate Tax Portability Election Extended Virginia Cpa

How Changes To Portability Of The Estate Tax Exemption May Impact You

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break

Final Regulations Confirm No Estate Tax Clawback Center For Agricultural Law And Taxation

Getting The Most Out Of Your Marriage Can Be A Good Thing

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

New York S Death Tax The Case For Killing It Empire Center For Public Policy